According to Wan et al. (2021), the sales of Electric vehicles (EVs) keep on maintaining rapid growth, which has become the biggest bright spot in the market. This is an indication of a viable business opportunity begging the question; how to invest in EV charging stations?

Types of EV Charging Stations

Before exploring the various ways one can invest in EV charging stations, here is a look at the common types of EV charging stations.

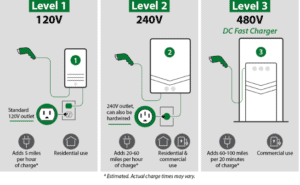

Level 1 Charging Stations

These are the most basic and it is commonly found in households. They use the standard 120-volt household outlet, providing a slow but steady charge to EVs.

Besides being cost-effective and easy to install, they are better suited for overnight charging due to their relatively low charging speed. This is an excellent choice for residential settings and locations where vehicles remain parked for an extended period.

These stations/equipment cost around $200-$400 and installation is typically under $100.

Level 2 Charging Stations

When compared to Level 1 charging stations, these offer a faster charging option. This is because they operate on a 240-volt system, making it possible to significantly reduce the charging times.

This is a charging type that is well-suited for diverse settings, including workspaces, commercial areas, and public places. These are places where owners might be indeed of a quicker top-up. Hence, it is their versatility and faster charging speed that make them a popular choice for both businesses and public infrastructure.

The equipment costs for this station range from $400-$6,500, and installation costs can vary from $600-$12,700, depending on electrical upgrades needed. This estimate is per port.

DC Fast Chargers

These are Direct Current (DC) fast charges and they represent the pinnacle of EV charging speed. The reason behind this is that they supply a high-voltage DC charge directly to the vehicle’s battery, enabling it to be rapidly replenished – in most cases, it’s less than 30 minutes.

These stations are typically found along highways and major travel routes, catering to the needs of long-distance travelers.

Despite being the fastest option, they require more substantial infrastructure, making them less common in everyday settings. This highlights the importance of the trade-off between speed and costs for business people/investors interested in the DC fast charging segment.

The equipment costs for this station setup range from $10,000-$40,000 per port, and installation can cost $4,000-$51,000, often due to extensive infrastructure upgrades needed.

How to Invest In EV Charging Stations

There are two key ways to invest in EV charging stations. These are direct and indirect investments.

1. Direct Ownership

Basically, just as the name suggests, this type of investment entails owning and operating your own station. People, businesses, or investors opting for direct ownership commit substantial upfront capital investment and other resources as well. The good side of it is that it offers significant returns.

Here is a simple breakdown of the key aspects:

Please note that the figures are a mere estimate, based on the time the information presented in this article was researched and published.

Upfront Capital

The initial capital for EV charging stations would vary widely based on the type and number of charging stations. On average, installing a Level 2 charging station may cost between $6,000 and $20,000, while DC fast chargers can range from $20,000 to $100,000 or more per unit.

Concerning setting up the network of charging stations, a more substantial investment is required. This potentially ranges from hundreds of thousands to millions of dollars depending on the scale and infrastructure complexity.

Permits and Regulatory Compliance

Permits vary based on location/state and regulations present. The current estimates suggest permit expenses range from $1,000 to $10,000 per charging station. About regulatory compliance costs which include legal consultation fees, they range from $5,000 to $20,000. This is dependent on the complexity of local regulations.

Ongoing Maintenance

Charging stations’ routine maintenance ranges from $1,000 to $5,000 per station annually. This covers inspections, software updates, and repairs. Also, do not forget that emergency maintenance or repairs could incur additional costs.

Potential Return on Investment (ROI)

The potential ROI for owned and operated charging stations is high. This is especially true if they are strategically located in areas with high EV traffic and amenities that attract users.

While the estimates might vary, an EV charging station that is well-placed could generate an annual revenue of $10,000 to $50,000 or more. This is completely dependent on the usage patterns.

2. Indirect Investment

This is the other option and the most preferred way of investing in EV charging stations. Under this type of investment, one can opt for investing in charging equipment manufacturers or opt for EV-related Exchange Traded Funds (ETFs) or mutual funds.

Investing in Charging Equipment Manufacturers

Prominent companies in the EV charging infrastructure landscape like Tesla, ChargePoint, and Tritium offer a way of making money from the business. People/investors are able to invest in stocks of these charging equipment manufacturers and gain exposure to the increasing demand for charging systems without directly undertaking the operational responsibilities related to the ownership of the stations.

Regarding potential returns, the ROI is relatively good. For instance, Tesla stock prices have seen substantial increases over the years.

The important thing to keep in mind is that investing in individual stocks entails certain risks, such as market volatility and company-specific challenges. In this case, diversifying the charging equipment manufacturers might help mitigate these risks.

Investing in EV-related ETFs or Mutual Funds

For those looking for exposure that is more diversified to the entire EV sector, EV-related ETFs or mutual funds provide an attractive option. These funds typically comprise a basket of stocks from various companies, involved in EVs, charging infrastructure, battery manufacturing, and related industries.

Understand how to Convert 403b into Silver & Gold Investment

Concerning the potential returns, the returns are dependent on the collective performance of the underlying stocks. Some ETFs like Global X Autonomous & Electric Vehicles ETF (DRIV) and iShares Self-Driving EV and Tech ETF (IDRV) have gained attention over the last few years.

The Future of the EV Charging Station Business

The future of the EV charging station business is dynamic and promising. This is on top of being driven by the ongoing global transition towards electric mobility, technological innovations, supportive government policies, and a growing awareness of environment sustainability – a green economy.

Among the reasons why this is so is the increased adoption of EVs. As automakers keep on investing in and releasing new EV models, the demand for charging infrastructure will probably escalate. For example, in the case of Tesla, the company has consistently invested in research, development, and production of new EV models that are appealing to a broad consumer base. By introducing Model S, Model 3, Model X, and Model Y, the company has showcased its commitment to the provision of options that cater to different preferences.

The ongoing advancement in charging technology, like higher charging speeds, improved energy efficiency, and wireless charging capabilities are a way towards the enhancement of the charging experience. Over the past few years, there has been an expansion of the charging network. This is an indication of the rising nature of the demand for EVs as charging station networks are expanding both geographically and in terms of the number of charging points.

A key aspect of the 17 Sustainable Development Goals (SDGs) of the United Nations is the fight against climate change, the greenhouse effect, and the need to adopt sustainable practices. With EVs backing up this vision by incorporating renewable energy sources like wind and solar, it assists in making it possible. This trend assists in the reduction of carbon footprints associated with both EVs and their charging stations. Hence due to this, the EV charging station business is viable now and in the future, since even the government itself is supporting it through its policies.

Final Remarks

Direct ownership and indirect investment are the key ways how to invest in EV charging stations. For those with a penchant for hands-on ventures, direct ownership involves substantial upfront capital but promises significant returns. Strategic location matters and the potential ROI is high, ranging from $10,000 to $50,000 annually. Indirect investment is a more diversified approach. It entails investing in charging equipment manufacturers like Tesla or opting for EV-related ETFs providing exposure to the growing demand without operational hassles.

Reference

Wan, J. P., Xie, L. Q., & Hu, X. F. (2021). Study on the electric vehicle sales forecast with TEI@ I methodology. International Journal of Knowledge Engineering and Data Mining, 7(1-2), 1-38.