Although they are meant to be as simple and straightforward, bank statements are at times confusing particularly when they are filled with various charges, credits, and descriptions. Among such descriptions/terms is the “CSC Service.” Often written in its initials makes many wonder “what is CSC Service work in bank statement.

What Exactly is CSC Service

CSC service is a term that refers to charges connected with a service provider involved in handling electronic transactions. Many times, the terms are relevant in the context of card services and payment processing.

The acronym CSC does not stand for a single term, it stands for different things. It might stand for Customer Service Charge, Card Security Code, or even represent a certain company like Computer Sciences Corporation. Despite the differing meanings, each plays a role in the backend of credit and debit card transaction processing.

Customer Service Charge

Under this meaning, CSC stands for a fee imposed by financial institutions or service providers for the support and assistance they provide to their customers/clients.

The charge covers a range of services like:

- 24/7 Customer Support: Access to round-the-clock customer service representatives who can assist with account inquiries, transaction issues, and other banking needs.

- Account Management Services: Help with managing your bank account, such as setting up automatic payments, resolving disputes, and updating personal information.

- Technical Assistance: Support for troubleshooting issues related to online banking, mobile apps, and other digital banking tools.

Basically, these are charges meant to make sure that customers receive timely and effective assistance and have a smooth banking experience. Typically, the service fee is included in the monthly bank statement as CSC Service.

Card Security Code

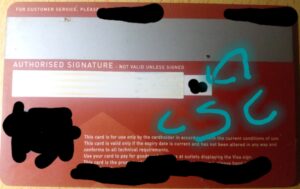

Also known as Card Verification Value (CVV) or Card Verification Code (CVC). As a CSC, it serves as a critical component in securing electronic transactions.

It is the three-four (3-4) number found on credit and debit cards that are found at the back of the card near the signature strip or on the front for some cards like American Express.

The major purpose of this form of CSC is to provide an additional layer of security during online or over-the-phone transactions. It operates as below:

- Verification: When you make a purchase, especially online, you are required to enter the CSC along with your card number and expiration date. This step helps verify that you have physical possession of the card.

- Fraud Prevention: By requiring the CSC, merchants and financial institutions can reduce the likelihood of fraudulent transactions. Even if someone has your card number and expiration date, they would still need the CSC to complete a transaction.

- Data Protection: The CSC is not stored by merchants after the transaction is processed, which helps protect your card information from being compromised in data breaches.

Charges related to the processing and verification of the CSC appear on the bank statement under CSC Service.

Service Providers

Yet another meaning of CSC Service is charges from service providers like Computer Sciences Corporation. This is a renowned company for offering a wide range of IT services including payment processing solutions.

In terms of playing a part in the development of existing financial infrastructure, such companies attain it through:

- Payment Processing: These providers manage the technical aspects of processing credit and debit card transactions. They ensure that the transaction data is transmitted securely between the merchant, the card network, and the issuing bank.

- Security Solutions: They implement advanced security measures to protect transaction data from fraud and cyber threats. This includes encryption, tokenization, and compliance with security standards like PCI DSS (Payment Card Industry Data Security Standard).

- Technical Infrastructure: Service providers maintain and upgrade the systems that handle transaction processing, ensuring reliability, speed, and scalability. This infrastructure supports millions of transactions daily, requiring constant monitoring and optimization.

The costs associated with the maintenance and securing of the payment processing infrastructure also appear on the bank statement as CSC Service.

Why Does CSC Service Appear on Your Bank Statement?

The key reason why CSC Service exists is to offer transparency concerning where your money is going.

Each time a purchase is made using a credit or debit card, a series of processes take place behind the scenes in order for the transaction to the successfully and securely completed. During the process, multiple entities, including the merchant’s payment processor, the card networks (like VISA and MASTERCARD) and the respective bank interact together.

The connected fees are then passed to the consumer in the form of transaction fees. Such fees cover the cost of processing the transaction, ascertaining that it is secure and that funds are transferred from the bank account to the merchant’s account.

Related Post: How Gratuity Might Appear On a Bill

Although the fees seem on individual transactions, they add up over time, especially when frequent card purchases are made.

Besides the basic transaction processing, CSC Service charges cover additional services offered by financial institutions or payment processors. Such services are customer support, and fraud prevention of IT services and they all play a part in the overall security and efficiency of the transaction process.

Subscriptions to services like streaming platforms, magazines, or software are connected with recurring CSC Service charges. This is due to the management and processing of the subscriptions as they seek to make sure that the subscription(s) are renewed without any interruptions.

Implications of CSC Service Charges

Understanding the implications of CSC Service charges is crucial for effective financial management. These charges can impact your budget, security, and the quality of services you receive. Here are some key points to consider:

- Incorporate into Budget – Regular CSC Service charges should be factored into your budget to avoid surprises. By anticipating these charges, you can better manage your monthly expenses and ensure that you have sufficient funds to cover all your financial obligations. This proactive approach can help you avoid overdraft fees and other financial pitfalls.

- Track and Monitor – Keeping track of these charges and monitoring them regularly can help you identify any unexpected or incorrect fees. By regularly reviewing your bank statements, you can ensure that all charges are legitimate and that you are not being overcharged for services.

- Investment in Security – Many CSC Service charges are directly related to security measures. These charges ensure that your card transactions are safe from fraud and unauthorized access. Understanding that these fees contribute to your financial security can provide peace of mind and justify their inclusion in your budget.

- Fraud Detection – The security measures funded by CSC Service charges help detect and prevent fraudulent activity. This includes monitoring transactions for unusual activity, implementing security protocols for online purchases, and providing tools for reporting and disputing fraudulent charges. By paying these fees, you are investing in the security and integrity of your financial transactions.

- Reflecting Service Quality – The fees you pay for CSC Service charges can reflect the quality and extent of customer support and services you receive from your bank or payment processor. Higher fees might indicate more comprehensive support and better security measures, while lower fees might correspond to more basic services.

- Enhanced Customer Experience – Paying for quality customer support can enhance your overall banking experience. Knowing that you have access to reliable and responsive support can make it easier to address any issues that arise with your account, providing a smoother and more satisfactory banking experience.

Final Thoughts

CSC Service on a bank statement related to charges related to transaction processing, security, and customer support services. It is a legitimate charge which plays a role in enabling a person to better manage their finances. Hence, it is important to always or regularly review your bank statements and contact the bank in case you have any questions or in case you identify a suspicious charge in your bank statement.