The National Tax Advisory Services (NTAS) is a company that specializes in the provision of tax-related assistance to people during tax season. As such, there exist some reasons for it calling you.

One possible reason is to remind you to file your taxes. With the deadline looming, it is not uncommon for tax advisory services to reach out to taxpayers to make sure that they do not miss the deadline and incur penalties.

Calling to offer their expertise in the optimization of deductions is also another reason for NTAS to call you. They might have identified areas where you would be able to save money on your taxes and want to discuss these opportunities with you.

The NTAS are not telemarketers trying to sell something unrelated to taxes. Their goal is to offer valuable services to taxpayers. Due to this, they are often calling to offer assistance with tax planning, tax preparation, or even representation in the case of a tax audit.

Key Takeaway

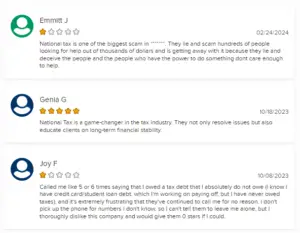

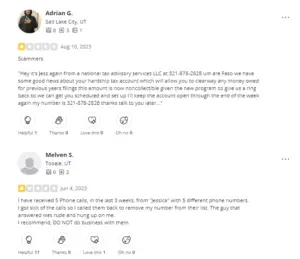

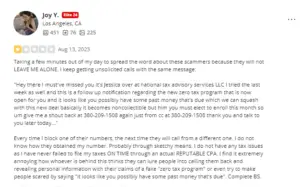

Why is National Tax Advisory Services calling me? There are two key reasons why the NTAS is calling. The first one is for a legitimate tax service. However, the negative reviews the company has on its Better Business Bureau profile and Yelp raises red flags. Because of this, the more likely possibility for NTAS to call you is to undertake a tax scam. Often, scammers use scare tactics and urgency to pressure people into paying for unnecessary services or revealing personal financial information.

The key red flags to watch out for include unsolicited calls because the IRS typically initiates contact by mail, promises of quick fixes, threats of jail or arrest, and high-pressure sales tactics.

Related Article: Why Am I Getting a Package from Fidelity National Financial

Why Use Tax Advisory Services

There are multiple benefits to using tax advisory services like NTAS.

Among them is assisting you in navigating the complexities of the tax code. This assists you in saving time and making sure that your taxes are correctly filed and the risk of errors or audits minimized.

Also, tax advisory services can help you to identify deductions and credits that you might have overlooked. They possess knowledge and experience in analyzing your financial situation and finding opportunities for potential tax savings. This could result in a higher tax refund and a reduction of tax liability.

The tax advisory services do provide peace of mind. By entrusting your tax-related matters to professionals, you get to rest assured that your taxes are properly handled. Apart from this, they also provide ongoing support and advice throughout the year. This means that you get to make informed financial decisions with tax implications in mind.

Ways of Handling NTAS Calls

When you receive a call from NTAs, start by attentively listening and asking questions in order to understand the purpose of the call. In case you are interested in their services, ask for more information about the specific assistance they can provide.

During the call, take notes. Write down key details like the name of the representative, their contact information, and any specific recommendations or offers they make. This will assist you in evaluating or counterchecking the information with what others might have experienced. It would also help you to make an informed decision.

Do not be ready to commit to their services immediately, let them know that you need some time to think about it. Also, request them to provide any written information or resources for you to review whatever you have talked about/discussed. Doing this will give you time to research and consider their services without feeling pressured to make a decision on the spot.

In case the representative keeps on pressuring you to make a decision while still on the call, be aware that it is not a legitimate call. Such behavior is a red flag and you should stand your ground and insist on getting more time to think about it.

What to Do After Suspecting a Scam Call

Scammers are able to impersonate any company around the globe. In the case of suspecting that a call from NTAS is a scam, there are certain steps you can take.

The first and most important is that you should never provide personal or financial information over the phone. This is unless you are absolutely certain of the identity of the caller. Legitimate tax advisory services will not ask for sensitive information during an unsolicited phone call.

If you are not sure of their legitimacy, ask for their contact information and verify it independently before sharing any personal details.

Second, be wary of high-pressure tactics or demands for immediate payment. Often, scammers use these strategies to coerce people into providing money or sensitive information. Tax advisory services that are legitimate would give you time to consider their services and will not rush you into making a decision.

How to Verify NTAS Calls Legitimacy

The first step of verifying the legitimacy of NTAS calls is by researching their company online and checking for any reviews or testimonials. If the company is legitimate, it has to have an online presence, which includes a website, social media profiles, and customer reviews. Also, there has to be active engagement on such platforms.

Get to contact the Better Business Bureau or your local customer protection agency to inquire about the company in question. They might have information regarding any complaints or scams related to NTAS.

While doing this, take your time since it is always better to be safe than sorry.

How to Avoid Calls from Tax Advisory Services

In case you are tired of unwanted calls from tax advisory services, there are steps that you can take.

You can register your phone number on the National Do Not Call Registry. Doing this will enable you to give you a choice of whether or not to receive telemarketing calls. Although it will not eliminate all calls, it would greatly reduce the number of unsolicited calls you receive.

Be cautious about providing your phone number online or in response to surveys, contests, or promotions. Carefully read privacy policies and opt out of any marketing communication if possible.

Final Remarks

If you are wondering: why is National Tax Advisory Services calling me? Do not worry, it is most probably a scam call. The unsolicited calls from the agency point to raising concerns about the company’s legitimacy. With multiple negative reviews on Better Business Bureau and Yelp, it is undeniable that they are scammers. Therefore, do not give out your personal information like Social Security number and bank details to them. When you receive their call, report the call to the Federal Trade Commission.